There’s no quick fix for poor credit. However, if you need to see immediate improvement in your credit score, don’t despair! There are some easy ways to build credit that will get you started in the right direction. A long journey begins with a single step, and that’s what we’ll talk about today. More specifically, we’ll cover 5 tips to build credit easily.

These 5 easy tips to build credit are considered “medium impact” approaches. On their own, they may not be particularly powerful, but when you combine them all, you can see a significant positive effect on your credit score. So, let’s dig in!

Prepare in Advance

Before you start, you’ll want to obtain copies of all three of your credit reports: TransUnion, Equifax, and Experian. You are entitled to one free report per year from the credit reporting agencies. You can also visit www.IdentityIQ.com and get your credit scores for a fee. Once you’ve received your credit reports, you can begin auditing them for incorrect information.

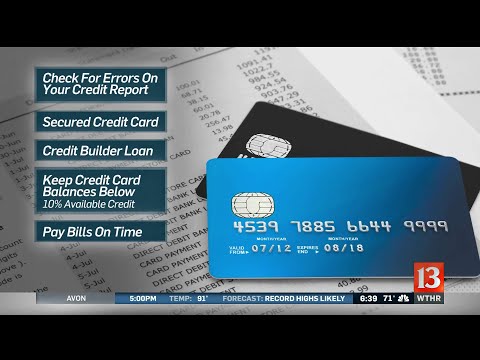

1. Dispute Outdated or Incorrect Information

The first simple step to improving your credit score is to dispute outdated information on your credit report. This includes, but is not limited to, incorrect and outdated name and address variations, as well as any other accounts that are past the 7 year mark and should have been removed.

As always, you’ll get the best results when your disputes are unique and specific to you and your situation. (In other words, don’t use “canned” disputes!) You can reference more detailed tips on disputing credit reports on this blog, as well.

2. Confirm Good Accounts are Being Reported

It’s not enough to delete incorrect info on your credit reports; you also want to get credit for your accounts in good standing! Check your credit reports to make sure that all of your good accounts are being reported correctly. Check the credit limits and other information on your positive accounts carefully. If there is an error, attempt to get it corrected by contacting the creditor. You may also have to write to the bureaus to ask for a correction.

3. Obtain a Secured Credit Card

Apply for a secured credit card in your name, with all your information. Use your own money for the deposit, and be mindful of your credit limit. Because a secured card requires a deposit, it can be a great option for folks who need to rebuild credit, or who are starting from scratch.

4. Keep Your Debt to Credit Ratio Healthy

Your debt to credit ratio (i.e. credit utilization) is a key metric in demonstrating that you are a responsible credit user! A healthy credit utilization is 10%, meaning that you’re using 10% of your available credit on average. If you are currently using a larger percentage of your available credit, this can be remedied by adding new credit lines, paying off some of your existing debt, or using “friendly loans.” In some cases, a credit builder loan can be helpful in this regard.

5. Pay On Time

This last step is particularly intuitive, but it is easy to miss. Improve your credit score by tackling any late payments that occurred in the last few months. If you’ve generally paid your accounts on time, many creditors will remove the record of a late payment as a “good faith” gesture to (hopefully) keep a happy customer. Often this can be done with a simple and polite phone call.

If you want the ultimate solution to improving your credit score, you’ll want to check out the services of InCreditable Advisors. We offer proven strategies and hands-on support wrapped into one complete system for improving your credit score. Book your credit Strategy Today!